RBGPF

63.5900

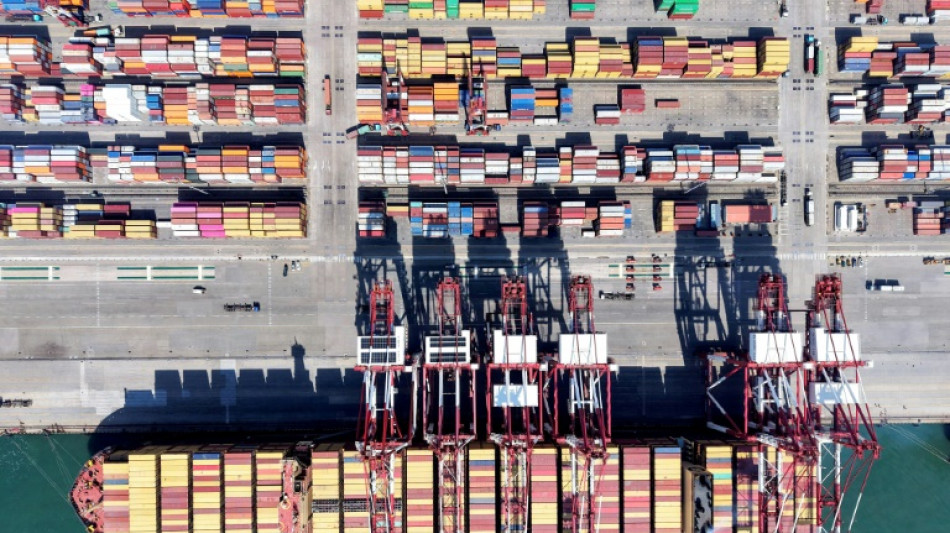

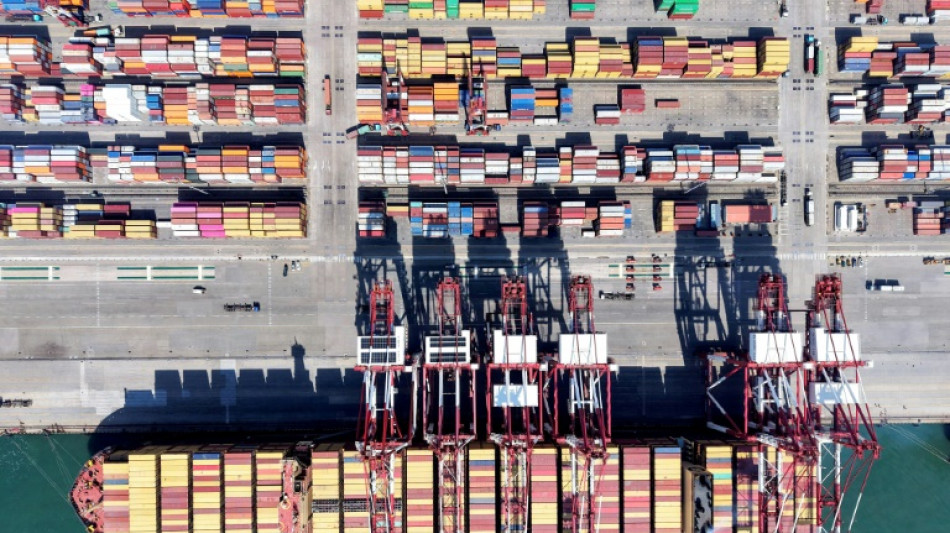

China said Wednesday its economy topped forecasts in the first quarter, as exporters rushed to shift goods ahead of swingeing US tariffs, but warned it faced "certain pressures" from Donald Trump's trade blitz.

Beijing and Washington are locked in a fast-moving, high-stakes game of brinkmanship since the US president launched a global tariff assault that has particularly targeted Chinese imports.

Tit-for-tat exchanges have seen US levies imposed on China rise to 145 percent, and Beijing setting a retaliatory 125 percent toll on imports from America.

Official data Wednesday offered a first glimpse into how those trade war fears are affecting the Asian giant's fragile recovery, which was already feeling the pressure of persistently low consumption and a property market debt crisis.

"At the moment, the imposition of high tariffs by the US will put certain pressures on our country's foreign trade and economy," Sheng Laiyun, Deputy Commissioner of the National Bureau of Statistics (NBS), told a news conference.

But, he said, "it will not change the general trend of China's economy continuing to improve in the long run".

The NBS said that "according to preliminary estimates, the gross domestic product in the first quarter... (was) up by 5.4 percent year on year at constant prices".

That was above the 5.1 percent predicted by analysts polled by AFP.

Retail sales, a key gauge of consumer demand, climbed 4.6 percent year-on-year, the NBS said, while industrial output soared 6.5 percent in the first quarter of the year, up from 5.7 percent in the final three months of 2024.

But Beijing warned the global economic environment was becoming more "complex and severe" and that more was needed to boost growth and consumption.

"The foundation for sustained economic recovery and growth is yet to be consolidated," the NBS said, adding there was a need for "more proactive and effective macro policies".

Figures released Monday showed Beijing's exports soared more than 12 percent on-year in March, smashing expectations, with analysts attributing it to a "front-loading" of orders ahead of Trump's so-called "Liberation Day" tariffs on April 2.

- 'Front-loaded' growth -

Observers say recent data will likely be overshadowed by more grim figures further down the line as tariffs begin to bite.

"The damage from the trade war will show up in the macro data next month," Zhiwei Zhang, President and Chief Economist at Pinpoint Asset Management, said in a note.

Steve Innes at SPI Asset Management said the figures "might look like a win on the surface, but let's not pretend this caught anyone off guard".

"Much of this was front-loaded -- fueled by a burst of preemptive activity ahead of US tariff escalations and an inventory binge stateside as importers scrambled to get ahead of the curve," he wrote.

Trump said this week that the "ball is in China's court" when it comes to drawing down those eye-watering tariffs.

China's economy, the world's second-largest, was already struggling to rebound from a pandemic-induced slowdown, with the double-digit growth that fuelled its rise now a distant memory.

Beijing in 2024 announced a string of aggressive measures to reignite the economy, including interest rate cuts, cancelling restrictions on homebuying, hiking the debt ceiling for local governments and bolstering support for financial markets.

But after a blistering market rally last year fuelled by hopes for a long-awaited "bazooka stimulus", optimism waned as authorities refrained from providing a specific figure for the bailout or fleshing out any of the pledges.

China's top leaders last month set an ambitious annual growth target of around five percent, vowing to make domestic demand its main economic driver.

Many economists consider that goal to be ambitious given the problems facing the economy.

But Beijing on Wednesday stressed it believed that target was achievable.

"We have the strength, capability and confidence to face external challenges and achieve our set development goals," the NBS's Sheng said.

M.Chau--ThChM